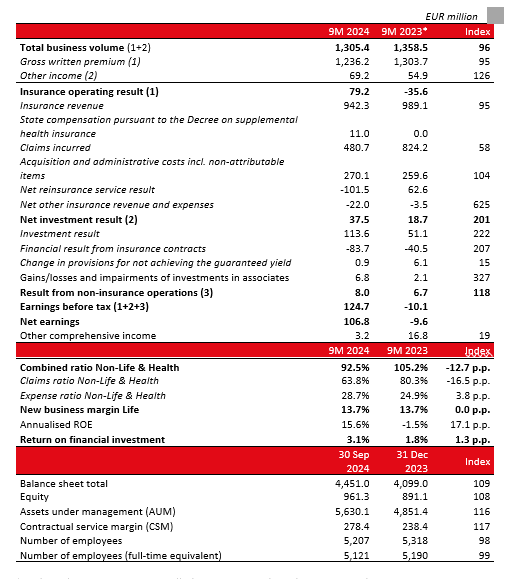

In the first nine months of 2024, the Triglav Group's earnings before tax stood at EUR 124.7 million (9M 2023: EUR –10.1 million) and its net earnings amounted to EUR 106.8 million (9M 2023: EUR –9.6 million). The Group achieved strong performance across all business segments. The total business volume reached EUR 1,305.4 million, a 4% year-on-year decline. However, when factoring in the effect of the shortfall in supplemental health insurance premium in Slovenia, it recorded an 8% growth. At the end of the first nine months, the Group reaffirmed its annual earnings before tax forecast of EUR 130–150 million, which includes the compensation received from the state. The Group continues to maintain its financial stability and capitalisation within the target range, positioning itself as a stable, safe and profitable investment for investors.

TRIGLAV GROUP'S EARNINGS IN 9M 2024

In the first nine months of 2024, the Triglav Group's earnings before tax stood at EUR 124.7 million (9M 2023: EUR –10.1 million) and its net earnings amounted to EUR 106.8 million (9M 2023: EUR –9.6 million). Zavarovalnica Triglav, the Group's parent company, generated earnings before tax of EUR 75.5 million (9M 2023: EUR 11.5 million) and net earnings of EUR 64.1 million (9M 2023: EUR 9.6 million). Andrej Slapar, President of the Management Board of Zavarovalnica Triglav, said: "This year, we have achieved strong performance across all business segments. Considering the anticipated business conditions for the remainder of the year, we reaffirm that we will exceed our original annual guidance, achieving earnings before tax of EUR 130–150 million this year. I would like to thank my colleagues for their dedicated work in reaching these goals."

In the first nine months of 2024, the Group generated nearly two-thirds of its earnings before tax, i.e. EUR 79.2 million, from its insurance business (9M 2023: EUR –35.6 million). The Non-Life segment's insurance result reached EUR 53.0 million, compared to EUR –19.6 million last year, which had been affected by extreme CAT events and inflationary pressures. Uroš Ivanc, a member of Management Board of Zavarovalnica Triglav, said: "This year's strong result in the Non-Life segment was driven by increased business volume, the impact of past premium rate adjustments, a 29% reduction in claims incurred compared to the same period last year, and the implementation of various underwriting risk measures." The Life segment's insurance operating result rose by 6% year-on-year to EUR 13.4 million. Meanwhile, the Health segment, following a loss last year, achieved earnings of EUR 12.8 million this year. It was aided by one-off effects, notably the state compensation received for supplemental health insurance.

The net investment result doubled year-on-year to EUR 37.5 million, while the result from non-insurance operations grew by 18% to EUR 8.0 million. Its growth primarily stemmed from managing clients' assets in mutual funds and discretionary mandate assets.

In terms of the results of the individual business segments, the Non-Life segment generated earnings before tax of EUR 75.4 million (9M 2023: EUR –8.8 million), the Life segment EUR 21.9 million (9M 2023: EUR 14.9 million), the Health segment EUR 14.3 million (9M 2023: EUR –29.2 million) and the Asset Management segment EUR 13.1 million (9M 2023: EUR 13.0 million).

PERFORMANCE HIGHLIGHTS OF THE GROUP IN THE FIRST NINE MONTHS OF 2024

The Triglav Group's total business volume of EUR 1,305.4 million was down by 4% year-on-year. However, when factoring in the effect of the shortfall in supplemental health insurance premium this year, it recorded an 8% growth. Except in Slovenia, where the business volume was affected by the aforementioned factor, the Group's written premium increased across most markets in the Adria region, achieving an overall growth of 8%. In the wider international environment, it experienced a 12% growth. In line with its targets, the share of the Group's premium written in Slovenia decreased to 57.3% (9M 2023: 63.1%), while the share from regional markets outside Slovenia rose to 20.9% (9M 2023: 18.4%) and the share from international insurance and reinsurance increased to 21.8% (9M 2023: 18.5%).

The Group's claims incurred amounted to EUR 480.7 million, a 42% decrease compared to last year. Estimated claims from major CAT events in the first nine months of the year totalled EUR 42.0 million, which is not significantly different from the level of previous years. The Group's operating expenses, including other attributable insurance service expenses, increased by 5% to EUR 327.3 million. Labour costs, amounting to EUR 150.2 million, represented the largest share at 44% of operating expenses, while acquisition costs, at EUR 79.4 million, showed the highest growth, increasing by 18%. Their growth was driven by increased business volume in markets outside the Adria region and higher sales through external channels.

The combined ratio of the Non-Life and Health segments stood at a favourable 92.5% (9M 2023: 105.2%). Meanwhile, the new business margin Life remained unchanged from last year at 13.7%. Other comprehensive income was low at EUR 3.2 million (9M 2023: EUR 16.8 million) due to the asset-liability maturity matching. Annualised net return on equity was 15.6%, driven by the strong increase in net earnings, whereas last year it was negative.

The Group's total assets under management as at 30 September 2024 amounted to EUR 5,630.1 million, up by 16% relative to the 2023 year-end. Of these, the Group companies managed own funds, unit-linked insurance assets and financial investments from financial contracts in the total amount of EUR 3,803.7 million (up by 12% relative to the 2023 year-end). The structure of this portfolio is comparable to the balance as at the 2023 year-end. The return on financial investments (excluding unit-linked insurance assets) rose by 1.3 percentage points year-on-year to 3.1%.

This year, the Group once again received a high "A" credit rating with a stable medium-term outlook from both S&P and AM Best. The Group remains financially stable and maintains liquidity and capitalisation at adequate levels. Uroš Ivanc, a Management Board member of Zavarovalnica Triglav, said: "At the end of first nine months, the Triglav Group's capitalisation remained within the target range of 200-250%, supported in part by the issue of a subordinated bond this year."

Financial highlights of the Triglav Group in 9M 2024

* The figures for the comparative period differ from those reported for the first nine months of the previous year, because the consolidated financial statements for this period were adjusted for the elimination of intercompany transactions. Total business volume in both periods no longer includes income from reinsurance commissions, resulting in a 4% reduction.